oklahoma state auto sales tax

As of july 1 2017 oklahoma charges a 125 percent sales tax on vehicle purchases in addition to motor vehicle taxes. Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4242 for a total of 8742 when combined with the state sales tax.

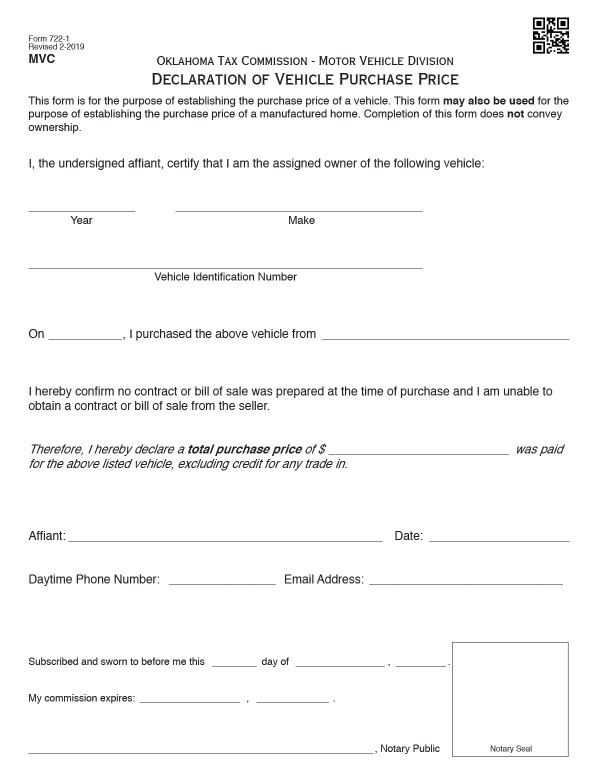

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Senate Majority Leader Kim David presented State Bill 593 on Tuesday.

. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase. 800 am to 430 pm. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

With local taxes the total sales tax. 4334 NW Expressway Suite 183 Oklahoma City OK 73116 Phone. OKLAHOMA CITY The Oklahoma State Senate passed a bill to reinstate full sales tax exemptions on motor vehicles and trailers.

635 for vehicle 50k or less. You can only avoid this tax if you purchase the car in a no sales tax state and then register the vehicle in that state as well. The minimum sales tax varies from state to state.

Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. In Oklahoma localities are allowed to collect local sales taxes of up to 200 in addition to the Oklahoma state sales tax. 31 rows The state sales tax rate in Oklahoma is 4500.

Darcy Jech R-Kingfisher would modify this calculation so the sales tax would be based on the difference between the actual sales price of a vehicle and the value of a trade-in if applicable. The maximum local tax rate allowed by Oklahoma law is. Localities that may impose additional sales taxes include counties cities and special districts like transportation districts and special.

Oklahoma city ok 73116 phone. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

425 Motor Vehicle Document Fee. Senate Bill 1619 authored by Sen. Car tax as listed.

Click Here to Start Over. What states have the highest sales tax on new cars. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

Does the sales tax amount differ from state to state. Oklahoma excise tax provided they title and register in their state of residence. An example of taxed services would be one which manufactures or creates a product.

The following is the Tax Commissions mission statement as it exemplifies our. Select the service you would like to access below. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. In Oklahoma you must pay an excise tax of 325 of the vehicles purchase price when you register it. Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of their purchase price provided.

You will be automatically redirected to the home page or you may click below to return immediately. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car. 405-607-8909 emailomvcokgov Office Hours. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax.

States with high tax rates tend to be above 10 of the price of the vehicle. The cost for the first 1500 dollars is a flat 20 dollar fee. Below are all state agencies currently utilizing OKgovs Online Bill Pay System.

775 for vehicle over 50000. This means that a freelance accountant would not be required to collect sales tax while a someone working in the creation of clothing may be required to. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax.

The state of Oklahoma does not usually collect sales taxes on the vast majority of services performed. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle.

State Assessment - Public Service Section Forms Publications Legislative Information Mapping Assessors Only Site Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools.

If I Buy A Car In Another State Where Do I Pay Sales Tax

What S The Car Sales Tax In Each State Find The Best Car Price

Bills Of Sale In Oklahoma The Templates Facts You Need

Virginia Sales Tax On Cars Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

States With No Sales Tax On Cars

Nj Car Sales Tax Everything You Need To Know

Oklahoma State Taxes 2022 Forbes Advisor Forbes Advisor

What S The Car Sales Tax In Each State Find The Best Car Price

States With No Sales Tax On Cars

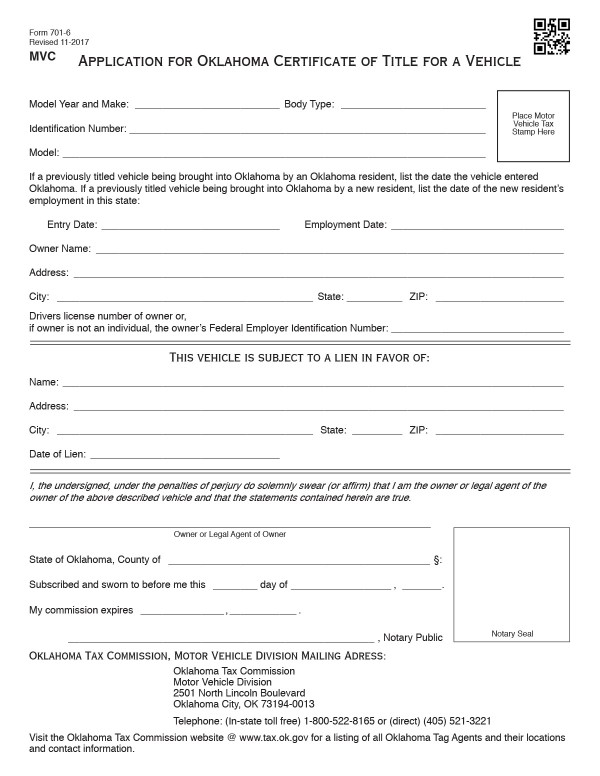

Oklahoma Vehicle Registration And Title Information Vincheck Info

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

A Complete Guide On Car Sales Tax By State Shift

States With Highest And Lowest Sales Tax Rates